Oh, No! They Rescheduled the Harry Styles Concert! Force Majeure and “Rain or Shine” Language in a Time of Disasters and Pandemics

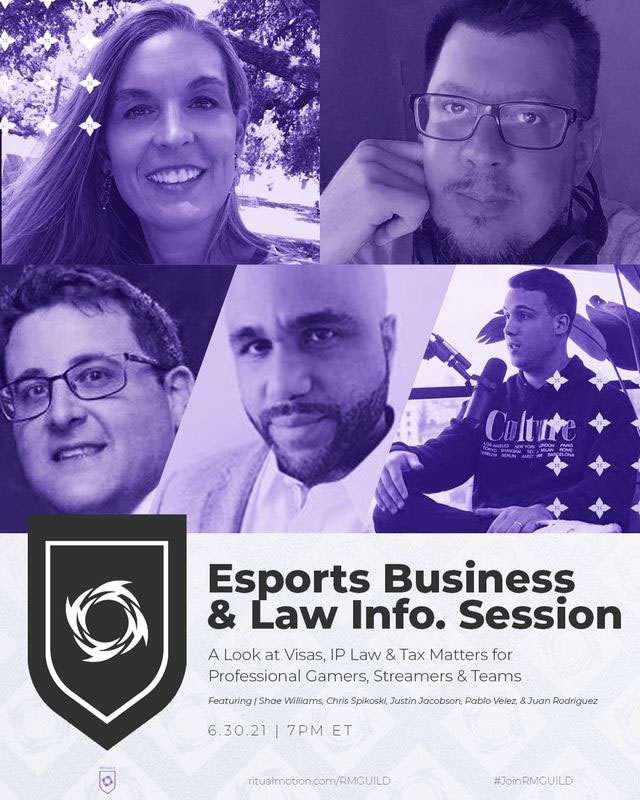

By Jeremy M. Evans, Esq. and Justin M. Jacobson, Esq.

The sale of many consumer goods, including concert tickets, indicates something along the lines of “rain or shine.” Does this include disasters that occur? What happens if a disaster happens? Do clients have a claim against the seller? How can attorneys advise these clients?

Considering today’s unpredictable weather as well as the ongoing COVID-19 global pandemic, there has been substantial discussion regarding cancellation policies as they relate to commonly used “rain or shine” policies for live events and attractions, as well as the potential usages of “force majeure” language. One way that attorneys have managed the risk for clients is by inserting protection clauses in agreements or other written documents entered into by these individuals or businesses. Some of these provisions include force majeure, indemnification, waivers, protocols, and a seemingly “moving target” approach to handling the continued uncertainty in an ongoing, unprecedented health pandemic. In many ways, states have varied in their approaches to the pandemic, but attorneys have been more consistent in their approach of protecting their clients from lawsuits or unnecessary risk. This article will explore legal approaches to the uncertainty caused by forces outside of each party’s control.

In any attorney-client relationship, trust is paramount. In any attorney-to-attorney or client-to-opposing-party or business relationship, trust is also most important. The parties should like or at least trust each to be flexible to make changes to an agreement as times and circumstances change in a way that benefits or harms both parties. This happened repeatedly during the pandemic when airlines and hotels rebooked and refunded planned trips. Attorneys and clients need to think about contingencies if and when things go wrong and how to make them right. It is a collaborative way of contracting and retaining customers. Parties that are too strict will lose trust and customers, which will affect their overall long-term profitability and sustainability.

The best example is one in the endorsement and sponsorship setting. The parties should want to work together to promote one another. If the parties find that they do not like each other, they should move on, as the relationship usually continues on a downward trend. In terms of business, companies should want customers and should try to be flexible within reason. In this respect, terms and processes should be outlined in detail in written agreements, policies, and “terms and conditions” on websites, backs of admission tickets, or elsewhere so that a purchaser or any other customer is aware of the applicable regulations associated with a specific transaction or purchase. The following are some ways attorneys have addressed some of these issues.

“Rain or Shine” Event Policies

It is common for many consumer goods, such as live sporting events, musical concerts, festivals, and other “ticketed” ventures, to include standard “terms and conditions” that apply to the purchaser of a particular good, such as an admission ticket. While each prospective client or business has its own specific language and necessary protections, there is a trend of live event production entities incorporating something along the lines of a “rain or shine” policy. This means that a specific live event such as an MLB baseball game (see, e.g., https://tinyurl.com/bdfpujhh) or an outdoor music festival (see, e.g., https://foresthillsstadium.com/faq) will occur whether the weather is amenable or if it is less than ideal.

There are, however, exceptions to this industry custom, such as the existence of extreme or severe weather conditions making it “unsafe” or “dangerous” to attend the event. For instance, popular musical artist Harry Styles had to reschedule a live concert due to the “dangerous” road conditions resulting from a hurricane in the area (https://tinyurl.com/2s4x462k). In an attempt to assuage fans, the concert was rescheduled to a later date in the year (https://tinyurl.com/msv7sxnd); this move might not be convenient for every potential customer, but it does provide an opportunity “for the show to go on.” Furthermore, the popular third-party ticket company Ticketmaster has its own established policy as it relates to canceled events (https://tinyurl.com/2p9ay2ar). The entity has gone as far as offering a purchaser event cancellation insurance that covers “the ticket price, taxes, convenience fees and shipping charges along with other eligible event-related items . . . such as parking” (https://www.ticketmaster.com/insurance). In light of today’s uncertain conditions, it is important to be aware of these policies and ensure that clients incorporate them to best protect their financial interest.

Generally, in many of these situations, most parties attempt to mitigate a patron’s loss and maintain public goodwill by rescheduling the event to a later date that hopefully does not encounter similar climate restrictions—sometimes referred to as a “rain check” (see, e.g., https://www.mlb.com/yankees/tickets/raincheck). Conversely, the operator may cancel the event altogether and refund the monies received from a client’s customers (see, e.g., https://electriczoo.com/ticketing-terms). However, in some cases, the amicable approach is not appreciated by all customers, which has resulted in a series of individual as well as class-action lawsuits by ticket purchasers against the event hosts in light of cancellations due to COVID-19 and other uncontrollable disasters (see, e.g., https://tinyurl.com/ypfnnshh; see also McMillan v. StubHub Inc., Case No. 20-cv-06392-HSG (N.D. Cal. Oct. 21, 2020); Bromley v. SXSW, LLC, No. 1:20-cv-439 (W.D. Tex. Apr. 24, 2020)). Therefore, it is crucial that a client has outlined operational procedures related to these types of situations beforehand to best protect themselves.

Force Majeure Clauses

In addition to the inclusion of “rain or shine” and other weather-related policies when crafting an event cancellation policy, attorneys can also advise clients to include contractual language to protect them in the form of a force majeure clause. This provision exists to excuse a party’s nonperformance under a contract when extraordinary events or a specific “triggering event” prevents a party from fulfilling its contractual obligations. Black’s Law Dictionary (10th ed., 2014) defines a force majeure “triggering event” as “an event or effect that can be neither anticipated nor controlled” and “includes both acts of nature such as floods and hurricanes, and acts of people such as riots, strikes, and wars.”

In extraordinary cases where a force majeure clause may be applicable, it is necessary to determine whether a specific event activates this provision, as its operability may eliminate or reduce any potential liability that a party might have for not performing their contractually obligated duty. In most circumstances, the terms of a contract are generally enforceable as written. In general, courts commonly look to and follow the express language contained in a force majeure clause when determining whether a particular event is listed and is therefore covered by this provision (see, e.g., Virginia Power Energy Mktg., Inc v. Apache Corp., 297 S.W.3d 397, 402 (Tex. App. Houston [14th Dist.] 2009, pet. denied) (“As we interpret the parties’ contract, including the force majeure provisions, our primary concern is to determine the parties’ intent”)). In fact, courts generally interpret force majeure clauses narrowly and will only enforce the clause and excuse a party if the provision “specifically includes the event that actually prevents a party’s performance” (see, e.g., Reade v. Stoneybrook Realty, LLC, 63 A.D.3d 433, 434 (2009) (citing Kel Kim Corp. v. Central Mkts., 70 N.Y.2d 900)).

Because many courts commonly rely on the express language of a force majeure clause when determining whether a specific event is covered, it is crucial to ensure that a force majeure clause is incorporated in a client’s contract. Additionally, it is important to ensure that the drafted language explicitly lists all the possible triggering events covered by the provision (see, e.g., Virginia Power Energy Mktg., Inc v. Apache Corp., 297 S.W.3d at 402). This is because the inclusion of more specific language may make it more likely that the provision might be applicable to the specific situation (see, e.g., Perlman v. Pioneer Ltd. Partnership, 918 F.2d 1244, 1248 n.5 (5th Cir. 1990); Virginia Power Energy Mktg., Inc v. Apache Corp., 297 S.W.3d at 402). As a result, it is prudent to ensure a client unambiguously includes and directly mentions applicable force majeure events in the agreement, such as “COVID-19” along with other related verbiage such as “epidemic,” “pandemic,” “public health crisis,” “governmental or regulatory orders,” and/or “governmental restrictions on performance.” This way, a client is properly protected in the event of the occurrence of any of these events. Furthermore, in addition to explicitly stating the various applicable events, a party could also incorporate broad “catchall” language (e.g., “or other similar causes beyond the control of such party”), which might provide arguments for relief for events that were unforeseeable at the time of contracting and those that were not specifically mentioned and incorporated in the force majeure language.

In cases where a client has used a force majeure clause in an agreement that does not include language explicitly referring to COVID-19 or other wording related to a health pandemic, and one or both of the parties’ performances are prevented due to the virus outbreak, one or both parties may look for relief under other interpretations of the language contained in many force majeure clauses such as claiming that the event is an “act of God” or “act of nature.” Black’s Law Dictionary defines an “act of God” as “an overwhelming, unpreventable event caused exclusively by forces of nature, such as an earthquake, flood, or tornado.” This could apply to “unusually severe weather,” which has been described as “adverse weather which at the time of year in which it occurred is unusual for the place in which it occurred” (Allied Contractors, Inc., I.B.C.A. No. 265, 1962 B.C.A. ¶ 3501, 1962 WL 9712 (I.B.C.A. Sept. 26, 1962)). Some courts interpret an “act of God” as one that solely occurs from natural forces, events, or causes (see, e.g., McWilliams v. Masterson, 112 S.W.3d 314, 320 (Tex. App. Amarillo 2003, pet. denied) (“[A]n event may be considered an act of God when it is occasioned exclusively by the violence of nature.”); Nat. Res. Def. Council v. Norton, 236 F. Supp. 3d 1198, 1220 n.9 (E.D. Cal. 2017) (quoting Black’s Law Dictionary 718 (9th ed. 2009); Cal. Civ. Code § 1511(2)).

As a result, these courts might consider “acts of God” as those without any “human intervention,” and it may be argued that humans have been involved in the COVID-19 health crisis (Travelers Ins. Co. v. Williams, 378 S.W.2d 110, 113 (Tex. App.—Amarillo 1964, writ ref’d n.r.e.). However, in light of the unprecedented global health epidemic, some state courts have begun expanding the definition of what qualifies as a “natural disaster,” which is commonly inserted to in these types of provisions (see, e.g., JN Contemporary Art LLC v. Phillips Auctioneers LLC, No. 20-cv-4370, 2020 WL 7405262, at *7 (S.D.N.Y. Dec. 16, 2020)). A New York state court noted that “[a]lthough neither the New York Court of Appeals nor the Second Circuit Court of Appeals has yet addressed whether the COVID-19 pandemic should be classified as a natural disaster, the Second Circuit has identified ‘disease’ as an example of a natural disaster” eligible for force majeure protection in agreements that currently mention “natural disasters” as a potential clause triggering event (Badgley v. Varelas, 729 F.2d 894, 902 (2d Cir. 1984)). It will be interesting to see which other states follow suit as similar cases are decided.

Finally, it is paramount that a client is aware of the listed remedies provided for by a contract’s force majeure provisions. This is because the clause can be drafted to permit the cancellation or termination of the entire contract upon the occurrence of a provision “triggering event.” Alternatively, the agreement might only provide for less severe relief, such as merely excusing the delay and tolling an existing agreement until the incident is resolved. Therefore, it is important in assisting a client in navigating an unforeseen disaster to not only include a force majeure provision in most every agreement but also to ensure that the language has widespread applicability as well as provides the correct relief.

Doctrines of Impossibility, Impracticability, and Frustration of Purpose

In the event that no drafted agreement exists between the parties or if a written document does not contain a force majeure clause at all and does not otherwise address these types of unforeseeable events, there might be other available avenues to protect a client’s interest in the event that a disaster strikes. For instance, some states recognize and enforce a variety of common law defenses, including impossibility, impracticability, and/or frustration of purpose. These doctrines are intended to be applicable when some unforeseen and unexpected event has made the fulfillment of an obligation impossible or impracticable (see, e.g., FP Stores v. Tramontina US, Inc., 513 S.W.3d 684, 693 (Tex. App.—Houston [1st Dist.] 2016, pet. denied); City of Vernon v. City of Los Angeles, 45 Cal. 2d 710, 720 (1955) (“A thing is impossible in legal contemplation when it is not practicable; and a thing is impracticable when it can only be done at an excessive and unreasonable cost”)).

The doctrine of impossibility may excuse a party’s performance when the destruction of the subject matter of the contract or the means of performance makes the performance objectively impossible. Moreover, the “impossibility” must be produced by an unanticipated event that could not have been foreseen or guarded or otherwise protected against in the contract (see, e.g., 407 E. 61st Garage v. Savoy Fifth Ave. Corp., 23 N.Y.2d 275 (N.Y. 1968)). In addition, some states, such as California, have separately codified a contractual defense of impossibility that excuses performance when it is prevented or delayed “by an irresistible, superhuman cause” (Cal. Civ. Code Section 1511(2)). Similarly, the doctrine of frustration of purpose might be applicable; it does not require the impossibility of performance under a contract but rather may terminate a contract that no longer provides the benefits that the parties bargained for because of intervening unforeseeable events, and the now-frustrated purpose was the primary reason for entering into such contract (see, e.g., U.S. v. Gen. Douglas MacArthur Senior Vill., 508 F.2d 377, 381 (2d Cir.1974)).

It is clear that a disaster—whether it is a hurricane or tornado or a global health pandemic causing businesses to be mandated by the government to close or operate at limited or otherwise restricted capacity—are impossible and impractical to reasonably foresee at the time of contracting; in some cases, these events may frustrate the entire purpose of an agreement.

Indemnification, Waivers, and Dispute Resolution

In addition to the potential contractual provisions as well as some common law protections mentioned above, it is common for the parties to include language that indemnifies or holds the other party harmless against a potential loss or verbiage that solely indemnifies the individual who is taking the risk by organizing the event for another. In this case, there should be written policies and procedures in place prior to the occasion, specifically in production and live event scenarios. Additionally, the talent, attendees, and others should be encouraged to sign waivers of liability and/or give disclosures of symptoms related to COVID-19 as well as following any other state-issued laws or orders. Written policies related to live events should also discuss testing requirements for all attendees. Finally, dispute resolution procedures, such as arbitration or mediation, could be included in a provision in the agreement to help the parties alleviate problems by means short of litigation.

Overall, the potential losses and uncertainty of today’s current business landscape can potentially be mitigated through cooperative efforts between the parties as well as with proper written contracts with appropriate clauses addressing the procedures for a potential unforeseen disaster standing in the way of a performance.

This article is not intended as legal advice, as an attorney specializing in the field should be consulted.

Please review the article originally posted on the ABA website here (sorry, for ABA members only).

This article was originally published in GPSOLO, Volume 39, Number 2, March/April 2022, (c) 2022 by the American Bar Association. Reproduced with permission. All rights reserved. This information or any portion thereof may not be copied or disseminated in any form or by any means or stored in an electronic database or retrieval system without the express written consent of the American Bar Association or the copyright holder

On January 26, 2022, the fourth episode of "

On January 26, 2022, the fourth episode of " On January 12, 2022, the third episode of "

On January 12, 2022, the third episode of " On December 15, 2021, the second episode of "

On December 15, 2021, the second episode of " On December 1, 2021, the first episode of "

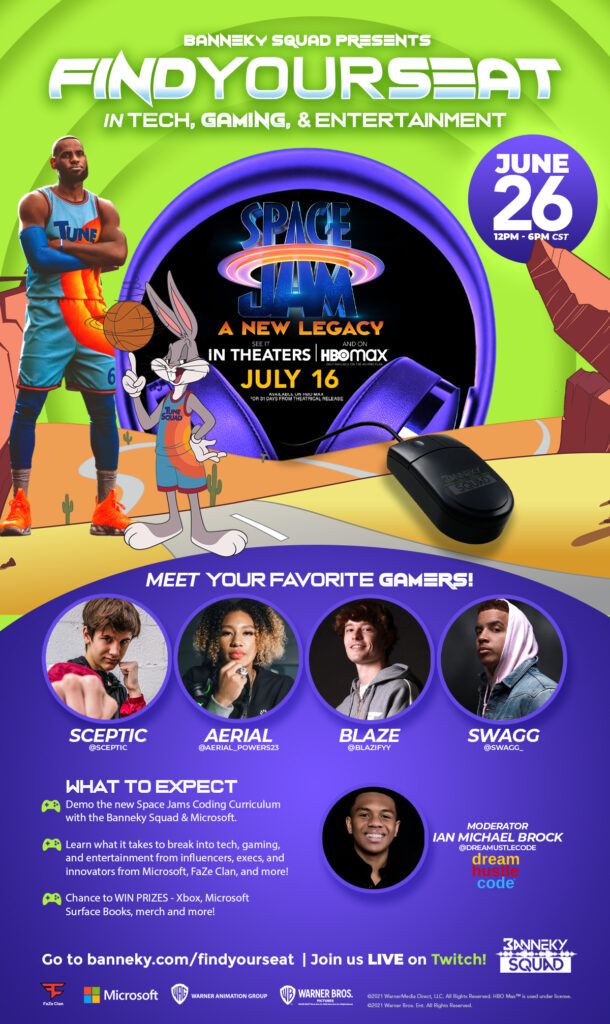

On December 1, 2021, the first episode of " On August 9, 2021, The #EsportsBizShow aired on

On August 9, 2021, The #EsportsBizShow aired on

On June 16, 2021,

On June 16, 2021,