Esports Business 101 – “The Landscape”

By Justin M. Jacobson, Esq. & Harris Peskin, Esq.

In the past few years, there has been an explosion of international exposure and interest in the world of competitive video gaming, better known as “esports.” Electronic sports or esports have evolved to the mainstream with professional video-gamers competing in a variety of games against other professionals for substantial sums of money. For instance, 2016’s DOTA2 Championship competition, “The International” in Las Vegas featured a partially crowd-funded prize pool of $20.7 million, including $9.1 million to the winner, $3.4 million to second place and $2.1 million to third place. Additionally, millions of people have also begun watching these tournaments and other live game-play on a variety of different content viewing platforms. This includes watching these competitions in person at arenas and stadiums in major markets. For example, tickets for the League of Legends’ World Championship Final event at the Los Angeles’ Staples Center sold out in less than an hour. ESPN has even gone as far as to integrate the esports game, “Rocket League” into its upcoming and iconic Summer “X Games” in its “X Fest”.

The most popular video game genres within the esports realm are fighting, real-time strategy (“RTS”), first-person shooters (“FPS”) and multiplayer online battle arena (“MOBA”) games. While there are many games, a few have stood out and become main stays on the international professional tournament circuits. Some of these include League Of Legends (“LoL”); Defense of the Ancients 2 (“DOTA2”); Counter-Strike Global Offensive (“CS:GO”); Overwatch; Hearthstone; StarCraft 2; Street Fighter V; Super Smash Brothers 4; and, Super Smash Brothers Melee. Each of these games is composed of a different assortment of players. Some have full teams who work together to battle against other teams; and, other games, like Street Fighter V, are merely a one versus one competition.

There are a few parties that compose today’s “professional” esports business as we know it. These include the league organizers, the game developers, the professional organizations, the professional players and the broadcasting platforms. We will look at each in turn, starting with the game developers.

The most powerful party in esports today is the game developer. Developers own the intellectual property rights to a game’s underlying software and are able to fully control and dictate the terms of any use of their game. In this respect, esports is extremely different from other traditional professional sports since any individual can play football or start their own professional football league (e.g., AFL, XFL) without the NFL having recourse against them. Conversely, if an individual wants to play “Overwatch” or start their own professional Overwatch esports league, they would have to secure a license through Blizzard Activision to utilize its copyrighted content for commercial purposes.

The game developers have the ability to offer unique original in game content. This provides a monetization opportunity and revenue stream that a traditional sports league can not provide. For example, fans’ purchase of an exclusive in-game item, a special “Conqueror Karma” skin, has contributed over $1.4 million to the League of Legends’Mid-Season Invitational prize pool. Unfortunately, traditional esports organizations do not have the ability to offer similar in-game rewards for a fan’s support or as part of a sponsorship arrangement. Since the game developer controls the software, all esports organizations must work with developers to create any in-game source of revenue. More often than not such an arrangement is structured as a royalty deal where the organization receives a specified percentage of income and the developer retains the rest.

Since developers own the intellectual property, all revenues derived through game licensing flows through them. They also have the ability to dictate terms to teams participating in their leagues. Teams do not have the ability to share in these licensing revenues. In 2016, Overwatch creator, Activision Blizzard reported earnings of $6.61 billion, the largest year in the company’s history and League of Legends owner, Riot Games earned a reported $21.9 billion. While it should not be expected that an esports organization would share in the game’s general revenues, it is worth noting that many of them had a hard time breaking even.

For example, Team SoloMid owner, Andy “Reginald” Dinh, published a long Social media post, directed at Riot Games’ President, Marc Merrill. In the post, Dinh voiced his concern for his and other organization’s long-term financial viability due to this earning and control imbalance. In this post, Dinh mentioned that certain developer restrictions, such as those on team sponsors, which are a necessary source of organizational revenue, create unavoidable stumbling blocks to the deals these organizations attempt to enter into. For example, sponsors, who typically require some sort of unique content in exchange for their contributions “can’t even go backstage to watch the players compete” and “teams can’t have sponsor branding on beverages or hats.” This severely restricts the players’ and organizations’ potential large and lucrative revenue streams. He states that there are even demands by game developers to “fine us [Dinh’s organization] if we didn’t remove sponsor content from our YouTube channel”. While the battle between game developers and the rest of the esports realm is debated in the media, this income discrepancy is a central stumbling block to the overall development of the esports commerce system.

Notwithstanding this barrier, another central player in esports business are the professional organizations. There are a variety of organizations that operate in various countries around the world, some of which have distinct teams for different games. The organizations enter into player contracts with gamers for their services and in exchange, the organization helps the talent with their associated expenses. This could include the paying of a player’s monthly or weekly salary, paying of amenities for their talent such as gaming houses or other housing options and for the player’s associated living and food expenses such as water and electricity. The organizations also provide the gamers with professional coaches, physical and mental trainers as well as supplying the players with gaming peripherals and equipment.

Some of these major organizations include Team Dignitas, which was acquired by the NBA’s Philadelphia 76ers; NRG eSports, whose investors include former NBA player Shaquille O’ Neal and former MLB players Alex Rodriguez and Jimmy Rollins; Team Liquid, whose investors include former NBA player Magic Johnson, Ted Leonsis and co-owner of the NBA’s Golden State Warriors and the MLB’s Los Angeles Dodgers, Peter Guber; Echo Fox Gaming, owned by former NBA player, Rick Fox; and; Renegades, owned by current NBA player, Jonas Jerebko. Each of these organizations may field a “team” comprised of a number of players, in at least one of the aforementioned major games.

As evidenced by some of the major investors in professional Esports organizations listed above, one of the most lucrative streams of income for an organization is outside investment. In recent years, there has been a series of multi-million dollar investments by prominent figures in sports, entertainment and technology industries infusing these organizations with funds to recruit new talent as well as pay and develop its current rosters. However, these investments should not be considered “revenues” earned by the professional organization as they are merely investment funds to help the organizations meet their financial obligations and are typically provided in exchange for an ownership interest in the entity.

In addition to outside investment funds an organization receives, they earn revenues in a variety of ways. Typically, the professional organization receives a set percentage of their team and/or player’s tournament winnings. This percentage can range from as little as 5% to 10% of the player’s winnings to larger amounts in some instances. Since an organization usually pays for the players’ living, travel and gaming expenses, this allows the organization to recoup some of these expenses. Sale of team merchandise has also become an additional source of income for esports organizations. Some have chosen to contract directly with merchandise distributors in exchange for a portion of the profit as opposed to producing their own inventory. Some other organizations have instead partnered with peripheral distributors and merely collect royalties on sales of “branded” items, including, mousepads, keyboards, and mice. In other instances, some organizations, such as Fnatic, have chosen to take that operation in-house and have started their own lifestyle/gaming equipment creation and distribution operation.

The primary source of income for an organization is from sponsorships, including a portion of an “estimate[d] $280 million […] spent on esports advertising last year … [which] figures to rise to $1 billion by 2021.” This is especially impactful since the target demographic for esports are males aged 17-25, a highly sought after demographic that is typically difficult to reach. These deals can be for as little as providing free equipment to the team all the way to multi-year, million dollar non-endemic sponsorships, depending on the reach of the organizations involved. For instance, Gillette recently entered into a partnership with the top Chinese League of Legends’ team, EDward Gaming as a way to break into the market. Additionally, McDonald’s recently continued its promotional efforts in the gaming space by signing on to be a sponsor of the upcoming “StarCraft II World Championship Series”. Some sponsorship arrangements may require product placement on visual creative content, including live streams as well as on official jerseys worn by the players and sold by the organization. The sponsorship arrangement could also require the provision of unique “fan” experiences or other exclusive content to provide the brand with added return on their investments in the organization.

Finally, organizations may receive funds from the live streaming of game content on various social media platforms such as Twitch and YouTube. Those platforms may offer organizations additional revenue provided players under their banner can reach a preset number of hours streamed or unique viewers. Organizations may also contract with these platforms for a portion of advertisement and subscription revenues received while a player under their banner streams.

Because of the small list of revenue streams available to a team and the rising cost of player salaries, many have argued that the industry is currently in a bubble which must be stabilized. In January 2017, ESPN stated that the average League of Legends player salary in North America is slightly over $100,000 a year. Understanding the available revenue sources to LCS teams and observing their current sponsorships, it becomes difficult to envision many breaking even on their yearly operating expenses.

Another prominent fixture in the Esports landscape is the player or “gamer.” Without the gamer, there would be no professional gaming as these are the individuals who actually compete in the gaming tournaments. Some of the top players can earn anywhere from $20,000 to $30,000 a year with some of the top players earning over $100,000; and, some, such as DOTA 2 player, Peter “ppd” Dager, the CEO of organization, Evil Geniuses, even pushing $1 or $2 million in prize pool earnings prior to an organization’s cut.

While organizations usually receive their largest income from investors, most players do not have investors, so they rely on the salary paid by their organization, in some instances prize earnings, and Twitch donations. Some of these prizes can be as large as $20.7 million, such as 2016’s DOTA2 Championship competition, “The International” in Las Vegas; and, depends on the number of participants, the game being played, the amount and level of tournament sponsors and the utilization of in-game crowdfunding.

An additional stream of income for a player, similar to organizations, is sponsorship monies. These deals can range from sponsorship in kind, whereby the third party sponsor provides equipment or where sponsorship monies are paid to the player. These sponsors are typically prominently displayed on the player’s website and associated social media platforms. Teams may choose to restrict the ability of their players to acquire sponsors so as to avoid lessening the value of their own sponsorships.

As described above, players may also generate revenue from streaming websites like Twitch and YouTube. These platforms provide the gamer with the opportunity to directly connect with their fans, who are generally part of this “key” demographic. For instance, some content streaming systems, such as Twitch, have live chatting features, which allow viewers to comment on what they view. There are also ancillary services, such as Streamlabs, which include “donating” and “tips” functions that enable viewers to “donate” funds to the streamer.

The final major component in the esports industry is the broadcasters. These include the live televised broadcast of the competitions, live streaming of the gaming content and the recent expansion to a 24/7 television channel dedicated entirely to esports.

One of the biggest factors in esports recent rise to prominence has been the television broadcast agreements that have begun to exist. For instance, in the U.S., Turner Broadcasting Network and its TBS television network have begun televising live “ELeague” competitions on its nationally televised channel. In addition, recently, Sportsnet in Canada entered into a licensing deal to broadcast Electronic Sports League’s (“ESL”) new esportsTV to its subscribers. These television networks receive fees from advertisers to air commercials during the live broadcasts of the tournaments, which are presented to millions of potential viewers. The success in televised esports has given way to the development of a 24/7 television channel, esportsTV, dedicated entirely to esports available through the media streaming platform, Playstation VUE. This new Esports channel is “part of PlayStation Vue’s top-tier Elite ($55 per month) and Ultra ($75 monthly) packages” and began with the broadcast of the Intel Extreme Masters tour, IEM Sydney, live from Sydney, Australia. In addition, Emirates Airline became the first major airline to enter into an agreement to provide on-demand esports inflight content. The airline will begin providing “highlights, clips and stories from major [ESL] global events; such as ESL One New York 2016 […and ] the world’s biggest esports event in history, the Intel Extreme Masters World Championship Katowice 2017” to its passengers.

In addition to televised competitions, live internet streaming of gaming content has brought professional gaming to more viewers than ever before. This includes the live streaming of tournaments, team practices and scrimmages as well as the provision of recorded and live general game-play and tutorials. Teams and gamers utilize a variety of streaming platforms; but, the most prevalent ones are Twitch.tv, YouTube and Facebook Live! The importance of these streaming content platforms cannot be overlooked as they have become one of the few consistent sources of income due to their substantial and consistent viewership. For example, according to SuperData’s research, the “worldwide gaming video content audience” is currently “665 million people” with a predicted increase of “21 percent […] between now and 2021.” This viewership number is more than the combined paid viewers of Hulu, HBO, ESPN and Netflix.

The data and demographics information that these streaming platforms gather has become so vital to the esports business ecosystem that it has led to an influx of exclusive content streaming agreements with various platforms for a variety of team organizations and game developers. For instance, Major League Gaming, owned by major game developer, Activision Blizzard entered into an exclusive streaming deal with YouTube for its MLG Vegas event as well as a recent deal to stream all of its upcoming events. Activision Blizzard also subsequently entered into other content streaming arrangements with Facebook Live! for different exclusive content.

Additionally, Team Dignitas, owned by the 76ers NBA team entered into an exclusive streaming partnership with Facebook Live! Team G2 recently announced that its gamers will stream exclusively on Facebook as well as the ESL recent creating an extensive streaming partnership with Facebook for its “IEM” and “ESL” One events. Twitter has also recently continued its pursuit of the live streaming crowd. In addition to the NFL Thursday Night Football streams, they have inked an exclusive streaming deal with Riot Games’ Oceanic, the creator of League of Legends.

While YouTube and Facebook Live! are making in-roads, Twitch.tv, owned by Amazon, is the largest online streaming service in the gaming world. The service allows anyone to broadcast themselves to the internet for viewer engagement. The platform permits the audience to leave comments for the streamer as well as to argue among themselves. It also allows integrations that permit the viewers to donate money to the streamers as well as the service can pay fees directly to the streamers when they start having substantial, consistent viewership. This is typically due to the paid advertisements that are embedded within the stream. Twitch has also recently expanded its esports impression by beginning to actually produce as well as broadcast new competitions, such as the upcoming Tekken World Tour, as Twitch “will run circuit events and build long-term infrastructure” for this competition.

Overall, the esports business landscape is ever shifting with the game developers taking the driver’s seat and dictating most of the terms of business. In addition, organizations have begun securing large sponsorship and broadcasting deals; however, without the constant influx of new players and the alternative content platforms to expose viewers to the talent, the business wouldn’t be as evolutionary as it has become. Only time will tell where esports business evolves from here, which could include the formalization of additional professional gaming leagues, such as the professional “Overwatch” league recently announced by Activision Blizzard.

This is an informative article and is not intended as legal or business advice, as an attorney or other professional specializing in the field should be consulted. This is merely a brief overview of a constantly evolving business eco-system as a more extensive conversation in each area is appropriate.

This article was reposted on the eSports Group’s blog.

© 2017, Justin M. Jacobson, Esq. & Harris Peskin, Esq

On January 26, 2022, the fourth episode of "

On January 26, 2022, the fourth episode of " On January 12, 2022, the third episode of "

On January 12, 2022, the third episode of " On December 15, 2021, the second episode of "

On December 15, 2021, the second episode of " On December 1, 2021, the first episode of "

On December 1, 2021, the first episode of " On August 9, 2021, The #EsportsBizShow aired on

On August 9, 2021, The #EsportsBizShow aired on

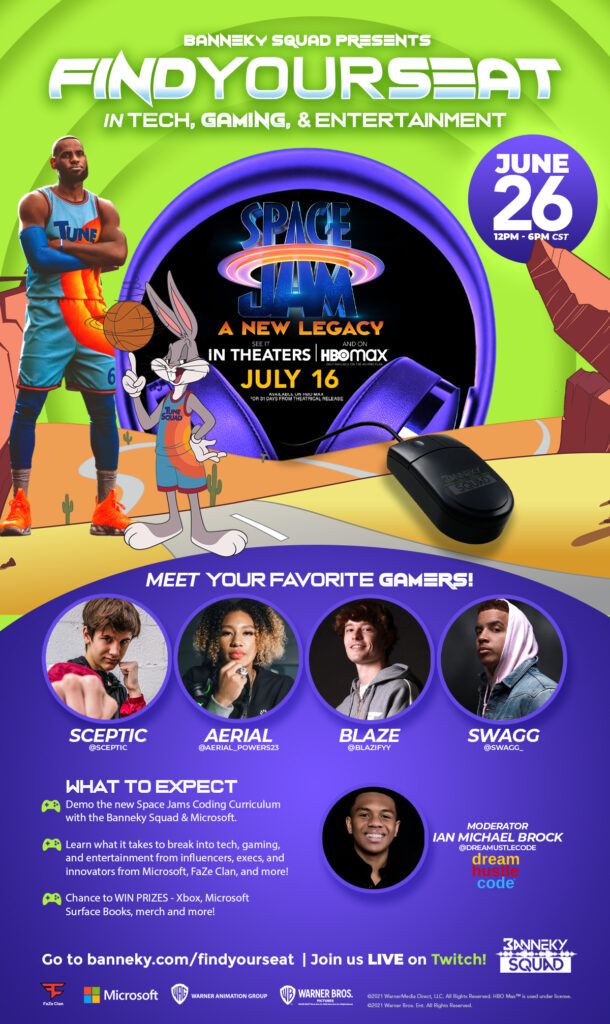

On June 16, 2021,

On June 16, 2021,

[…] has become a new buzz word among industry professionals and the masses alike. “Esports” refers to “electronic sports” and is the world of professional competitive gaming. It […]